Drewry Launches Latest Ship Operating Cost Data

With freight rates on the floor and asset values plummeting, control of the operating cost budget will be high on ship owners’ agendas. Now Drewry has just published its latest annual analysis of ship operating costs, covering nine ship types and over 35 different sizes of vessel making it the most comprehensive survey of this crucial area of vessel management. Ship Operating Costs 2009/10 an Annual report by Drewry Shipping Consultants Ltd is available for purchase (print & pdf GBP 1,290; pdf only GBP 1,195).

With freight rates on the floor and asset values plummeting, control of the operating cost budget will be high on ship owners’ agendas. Now Drewry has just published its latest annual analysis of ship operating costs, covering nine ship types and over 35 different sizes of vessel making it the most comprehensive survey of this crucial area of vessel management. Ship Operating Costs 2009/10 an Annual report by Drewry Shipping Consultants Ltd is available for purchase (print & pdf GBP 1,290; pdf only GBP 1,195).

Ending the Upward Trend

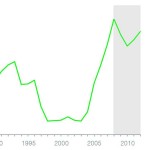

2009 sees an end to the upward trend in headline operating costs having reached a peak in 2008, daily operating costs are set to fall by an average of 3.4% this year. Areas such as manning have seen cost pressure ease as recession bit. A collapse in hull values has meant lower H & M premiums. Competition has lowered the costs of spares and management charges. Lower oil prices have reduced lube costs. This will undoubtedly help ship owners but the respite could be temporary; change is on the near horizon.

Temporary Respite

Ship costs fall under one of three main costheads – capital costs, operating costs and voyage costs. With markets in a poor state, operating costs provide owners with the greatest opportunity to have some control over their business environments, hence the significance of Drewry’s Report which will be eagerly read by ship owners, managers, marine insurers and ship repair yards alike.

Nigel Gardiner, Drewry Managing Director commenting on his company’s latest intelligence offering had this to say: “What is important to realize in all this is that recession for many shipping business managers is a new phenomenon… for the last few years all they have known is cost increases but these have been more than covered by continuous and robust rate increases.”

“All this has changed; the upward pressure on costs has been halted, if not reversed. However, at Drewry, we have been compiling and analyzing operating cost data for decades and we believe that this only a brief respite. Cost inflation will return, and we forecast it will hit 4.5% in 2012. The big unknown at the moment is the timing of recovery and when economic stimulus packages will kick-in. Owners and managers need to be ready to deal with cost inflation or run the risk of costs spiralling out of control.”

Key cost areas

In summary, the outlook for the key cost components is as follows:

Manning

In the near term, manning costs should remain stable after years of high upward pressure due to the shortage of skilled seafarers. Crew numbers have already been cut so there is not much scope for further reductions. But, as the total fleet size grows, cost increases could be back as soon as 2012 and so the shortage of crews will once again manifest itself. Wages being the largest component, inflation here will not be good news.

In the near term, manning costs should remain stable after years of high upward pressure due to the shortage of skilled seafarers. Crew numbers have already been cut so there is not much scope for further reductions. But, as the total fleet size grows, cost increases could be back as soon as 2012 and so the shortage of crews will once again manifest itself. Wages being the largest component, inflation here will not be good news.

Insurance

A difficult area to predict. Hull rates have risen in 2009 but declared values have gone down alongside a strong P&I hike. Hull values should go up next year although premium increases will be met with strong owner resistance. Despite this, the longer term is for insurance rate rises.

A difficult area to predict. Hull rates have risen in 2009 but declared values have gone down alongside a strong P&I hike. Hull values should go up next year although premium increases will be met with strong owner resistance. Despite this, the longer term is for insurance rate rises.

Repairs and maintenance

In the short term, costs will fall, particularly as steel costs have declined. Repairers should be able to cut prices while retaining margins. Parts of the fleet are ageing and so repair bills will inevitably rise. Owners are likely to be selective about work carried out to vessels. However, this area will be made worse by labour cost and raw material inflation.

In the short term, costs will fall, particularly as steel costs have declined. Repairers should be able to cut prices while retaining margins. Parts of the fleet are ageing and so repair bills will inevitably rise. Owners are likely to be selective about work carried out to vessels. However, this area will be made worse by labour cost and raw material inflation.

Stores & Supplies

Barring unforeseen hikes in oil prices this category should stabilize even possibly becoming deflationary – the cost of spares and lubes has fallen.

Management

Owners who normally use third-party providers may see advantages in bringing vessel management in-house. Lack of management experience could also be a serious factor in containing costs as a generation of managers has grown up with rate and cost inflation – deflation and recession will be novel experiences for many.

Nigel Gardiner summarized the situation operators face: ‘Overall, owners need to minimize costs but in a well managed way to avoid false economies. At the same time they need to have plans in place to deal with inflation’s return, particularly when interest rates rise, as inevitably they will.’