European renewables targets at risk

Wind turbine orders in Q3 2022 fell by 36% compared with Q3 2021. Europe urgently needs to solve permitting and strengthen its wind energy supply chain. Inflationary cost pressures, slow permitting and uncertainty around the EU’s emergency electricity market interventions are stalling orders for new wind turbines. WindEurope tracked orders for new wind turbines with a total of 2GW in Q3 2022*.

Wind turbine orders in Q3 2022 fell by 36% compared with Q3 2021. Europe urgently needs to solve permitting and strengthen its wind energy supply chain. Inflationary cost pressures, slow permitting and uncertainty around the EU’s emergency electricity market interventions are stalling orders for new wind turbines. WindEurope tracked orders for new wind turbines with a total of 2GW in Q3 2022*.

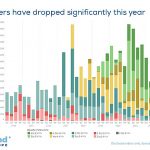

The orders came from nine countries. They were all for onshore wind turbines. Finland ordered most new capacity with 322MW, followed by the Sweden and Germany. This brings total orders in 2022 to 7.7GW – far off from what Europe needs to reach its energy and climate targets. The EU wants 510GW of wind energy by 2030. This means the wind industry should install 39GW of new wind each year up to 2030. At the current rate of turbine orders Europe would fall well short of this target. The Q3 numbers are part of a downward trend in wind turbine orders. Disclosed wind turbine orders* in Q1 2021 were at 2.8GW and have been generally decreasing since (see for illustration the below graph).

The rapid deployment of wind energy has never been more urgent – for energy security, for the climate, and for affordable energy prices. This requires a step change in EU policy: to accelerate permitting of new projects, give renewables investors visibility, and strengthen and expand of the European wind supply chain. At their 21st October European Council meeting, Heads of State and Government formally asked the European Commission to fast-track the simplification of permitting. In a recently published joint letter WindEurope called on the European Commission to table an emergency Regulation to that end using Article 122 of the EU Treaty. This would ensure renewables deployment is treated as a matter of overriding public interest and would shorten the maximum permitting duration to two years from the moment the first permit application is submitted.

Alongside improvements to permitting, investors and developers need clarity on future revenues to be able to move ahead with new projects and order new turbines. National Governments must clarify their approach to revenue caps on inframarginal producers of electricity (such as wind) as soon as possible in line with the industry’s six recommendations. Slow permitting and insufficient market size continue to harm the European wind energy supply chain. And costs for raw materials, components and international shipping have risen sharply, increasing the pressure on the European wind industry. The industry needs political support. The European Union must ensure that the Recovery and Resilience funding is channelled into strengthening and expanding the wind energy supply chain. The European Investment Bank can play a key role in supporting the supply chain, too. So can tax credits similar to those the US now use under their Inflation Reduction Act.

WindEurope’s Wind Turbine Orders Monitoring Q3 2022 contains additional details on new orders by wind turbine manufacturers, turbine models, average power ratings and turbine specifications. You can find it alongside historic Orders Monitoring reports and many other technology insights in the Members’ Area of our website. There you can also access interactive tools that allow you to check historic turbine orders data and OEM shares per country.

*Note: Publicly listed companies disclose their orders. WindEurope tracked fifteen firm orders for publicly listed OEMs. WindEurope then estimated the orders for non-listed OEMs.